Is Fannie Mae’s Stock Rally Built to Endure?

Fannie Mae (OTCQB: FNMA) has gained significant investor interest through its stock price surge, which reached $6.38 after dropping to $1.02 during the previous 52 weeks. The fundamentals of the Federal National Mortgage Association remain intricate despite the recent investor interest that has driven up stock prices. The ongoing volatility of fnma stock price on the over-the-counter market leads investors to question whether financial strength supports this growth or if they are simply riding speculative momentum.

A Look at Recent Stock Performance

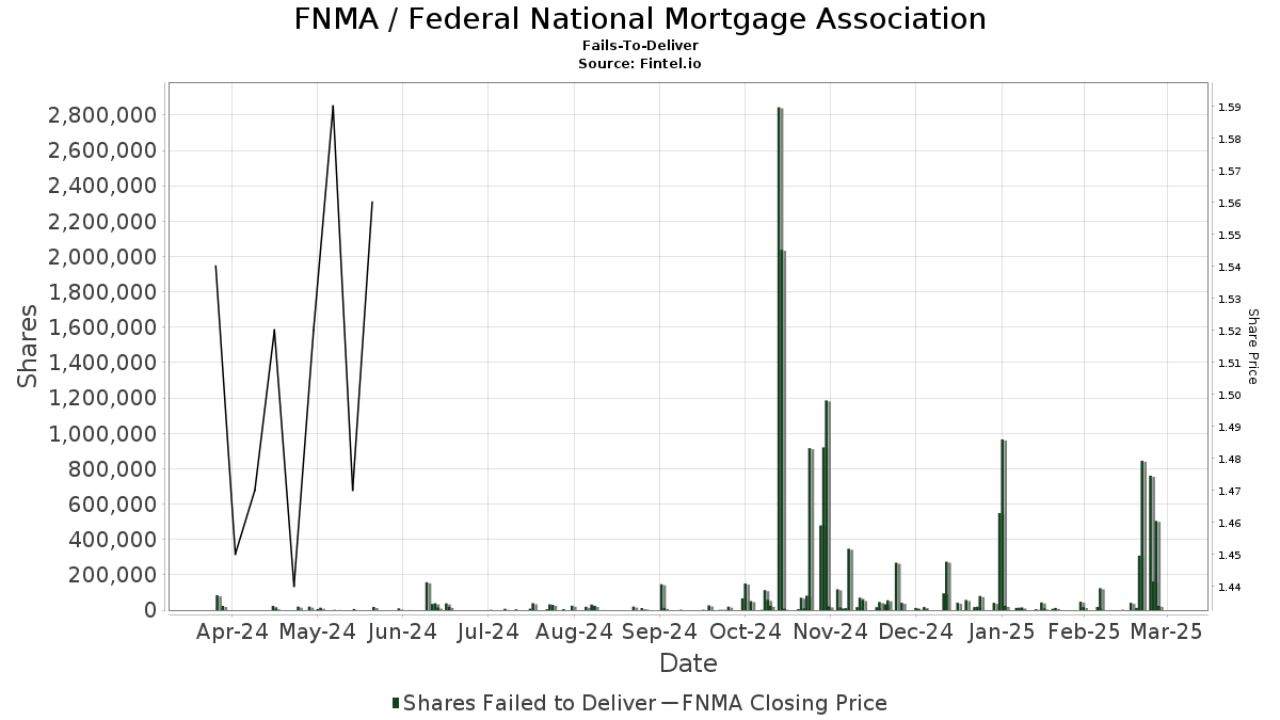

The stock value of Fannie Mae has experienced remarkable growth throughout the past year, increasing by more than 500% from its lowest point. Short-term momentum appears favourable for FNMA stock based on its recent 1.59% daily increase and its $8.00 52-week high. The trading activity of FNMA has become more noticeable to retail and institutional investors because its market capitalisation stands at $7.38 billion, and its turnover rate reaches 0.26%.

The current market rally takes place in an environment that lacks the standard transparency and stability characteristics of major stock exchanges. The company continues to trade on the OTCQB market, which primarily hosts businesses with minimal reporting standards and reduced market liquidity. The combination of potential gains and risks exists mainly because investors who want security instead of speculation need to consider this market.

Understanding the Business Model

The housing finance system of the United States depends heavily on Fannie Mae’s essential operations. The government-sponsored enterprise (GSE) operates by purchasing loans from mortgage lenders to provide them with financial liquidity. The ability of lenders to purchase more mortgages through this process supports homeownership and stabilizes the market. The Single-Family and Multifamily business segments of Fannie Mae operate as distinct units that support the essential housing infrastructure of the nation.

The company primarily works in the secondary mortgage market through complex mortgage securitisation strategies, including lender swap transactions and structured securitisations. Financial instruments used by the company help manage risk and support lending, yet create complex structures that make investment evaluation challenging.

Weak Fundamentals Behind the Rise

The impressive stock price increase at Fannie Mae reveals concerning financial metrics. The company’s price-to-earnings ratio exceeds 592 points, which stands as one of the highest ratios in the industry. The elevated valuation either reflects anticipated business expansion or speculative market behavior that diverges from actual earnings performance.

The market values Fannie Mae at a level below its book value because its price-to-book ratio stands at -0.16. The market appears to show little faith in Fannie Mae’s current assets or future earnings potential. FNMA fails to attract investors because it does not pay dividends and provides no yield like standard blue-chip stocks do. The current stock price does not appear to have solid fundamental support according to these market signals.

Regulatory and Legal Uncertainties

The long-term perspective for Fannie Mae becomes more complex because of its continuous partnership with the U.S. government. Fannie Mae faces an uncertain future structure after the government placed it under federal conservatorship during the 2008 financial crisis. Multiple attempts to reform or privatise the GSE have occurred throughout the years, yet no definitive solution has materialised. Shareholders currently operate in an unclear situation because regulatory actions and potential restructuring initiatives present risks to their equity value. The stock represents an unusual and high-risk investment because investors must predict both financial recovery and favourable political outcomes.

Investor Sentiment Remains Divided

The investor perception of Fannie Mae stands in clear opposition to each other. The recent stock price increase has optimistic traders believing in recovery and potential policy changes that could release shareholder value. The stock’s valuation exceeds its fundamental value according to skeptics who predict a market decline if any unfavourable policy changes occur. The lack of official guidance about government involvement and exit strategy from conservatorship keeps FNMA appealing to short-term speculators instead of attracting long-term investors. The divergent market perspectives about FNMA stock create an intriguing yet volatile situation that maintains its position as a focal point for market observers.

Conclusion

The increasing value of Fannie Mae stock demonstrates both investor interest and signs of market recovery. The market shows rising stock values, but investors face multiple valuation challenges alongside regulatory risks and speculative trading patterns. The essential function of FNMA in supporting the U.S. housing market does not simplify the investment decision regarding the company.

Speculative investors who accept high risks might find short-term opportunities in FNMA stock if the company demonstrates normal business operations or receives beneficial regulatory actions. People who want lasting financial stability, along with strong financial foundations, should exercise caution. The market has pushed the stock price upward, but the fundamental stability of this investment remains uncertain. Additionally, investors can explore the option to invest in US/Hong Kong stocks without the need for an offshore account, making this a potentially more accessible opportunity.